Financial educations to young clients

Launched in 2017, next bank came to offer a new digital bank experience to the public. All directly in smartphones, without complications and with Bradesco bank security and structure. Disney and next bank joined to create a product who offer financial education through a bank app and increase the young clients base.

Discovery.

Before the partnership we already had studies based in Bradesco ClickConta, desk research focused on Generation Z behavior and in how international banks managed to account for minors.

In this stage are considered some Product Discovery steps, we investigate market fit, possible forms to generate money revenue and values perceipt by the users. However, the business follows a different path suggested by the gathered data, focusing your product strategy on HIPPO's suggestions.

In parallel to the investigations, focus groups with mothers and teenagers were also conducted to understand the product idea’s appeal.

Based on the insights gathered during the discovery phase, we created four personas segmented by age group. This helped guide our creation process based on user profiles, their experiences, pain points, and opportunities.

Internal validation and production

After the information about the path of the project had followed, the UX team decided to do the best work with the specifications received and gather the maximum of data to justify the user necessities. We build a basic architecture for MVP with an evaluation of features decided by the project work group.

Fernando (awesome Product Design with a wide look of project) and I coordinate the production of more than 500 screens for the MVP implantation, meetings to create users stories with the partnership of squads, technical discovery and other ceremonies.

MVP Production

*

MVP Production *

There were no user tests in the conception, increasing the risk of the project. In parallel with the MVP production the UX team created actions to raise awareness to the problem and collect real data:

Product Discovery tools and dynamics with the involved squads (proto personas, business model canvas etc)

Pilot test with parents and kids, led by our researcher Janine.

Backlog creation based in improvements discovered

Critical vision and defense of real user in discussions

These app data plus the contracted research about the market allowed us most clean vision about the course of the product. With this we can, even if a little late, bring light to real necessities data based, taking a product reestructuracion with the real users and market in vision. I believe that user focused vision could do this rule supporting the product to reach the users and deliver mensurable value to them.

Interface and Experience.

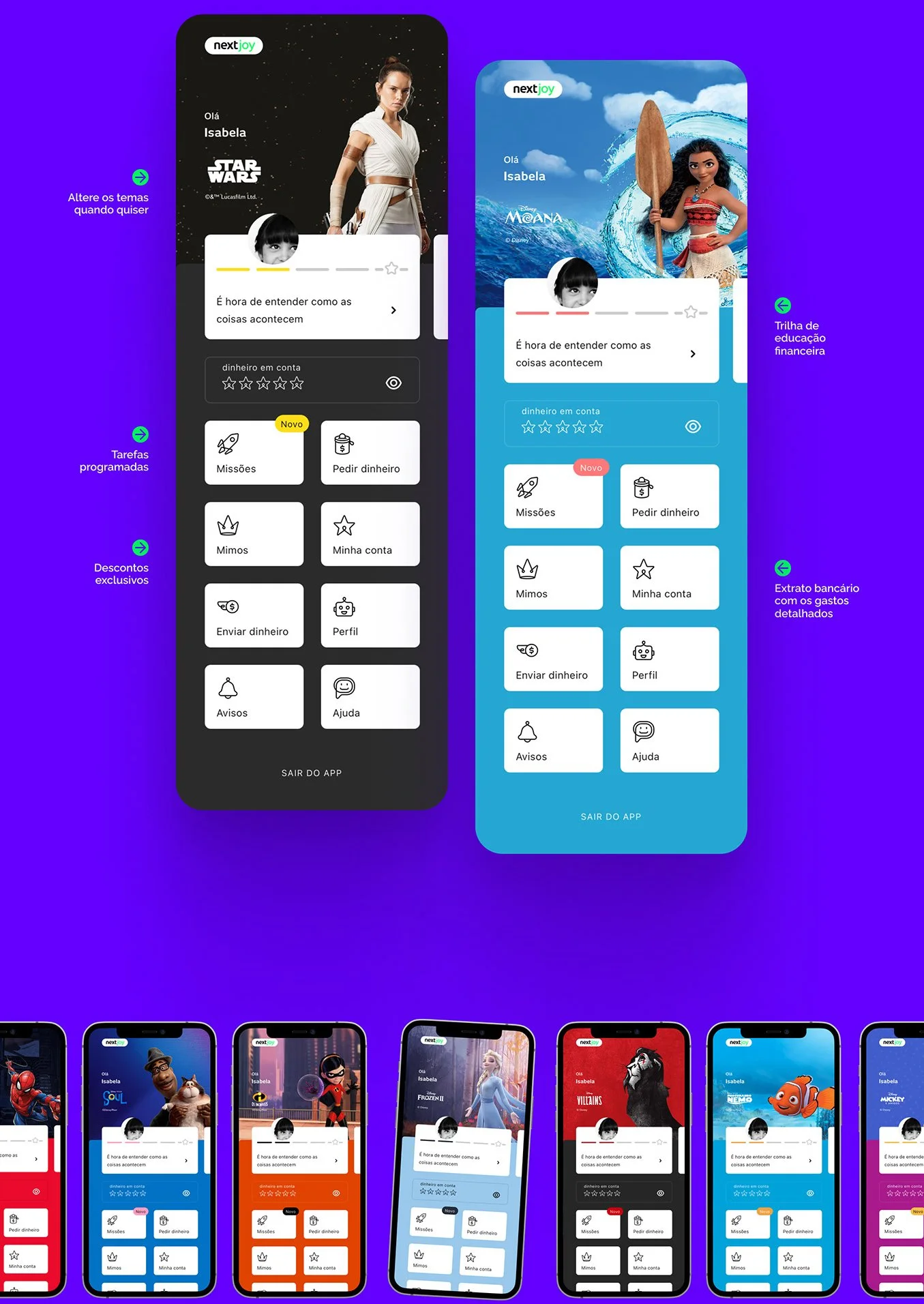

The experience takes place within the Banco Next app and NextJoy, which is exclusively for dependents. Dependents can fully customize their experience with their favorite theme featuring Disney characters.

Parental Control for Added Security

Guardians can monitor their dependent’s financial journey directly from their Next account, tracking transactions with daily limits and alerts.

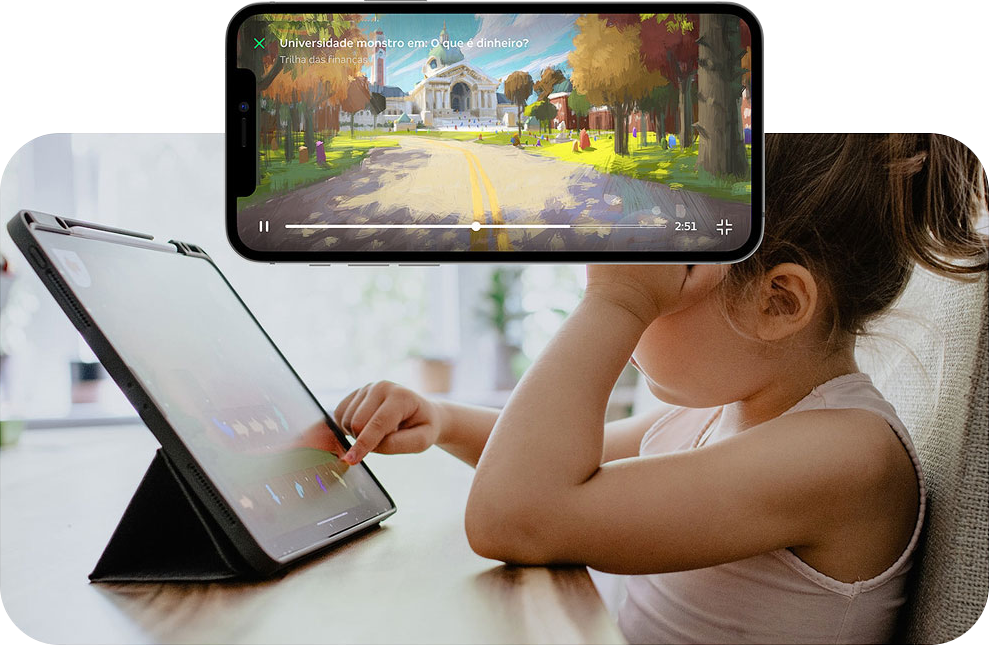

Gamification and Financial Education.

To support learning across different age groups, modules were created to deliver age-appropriate content, including videos, interactive texts, and sounds.

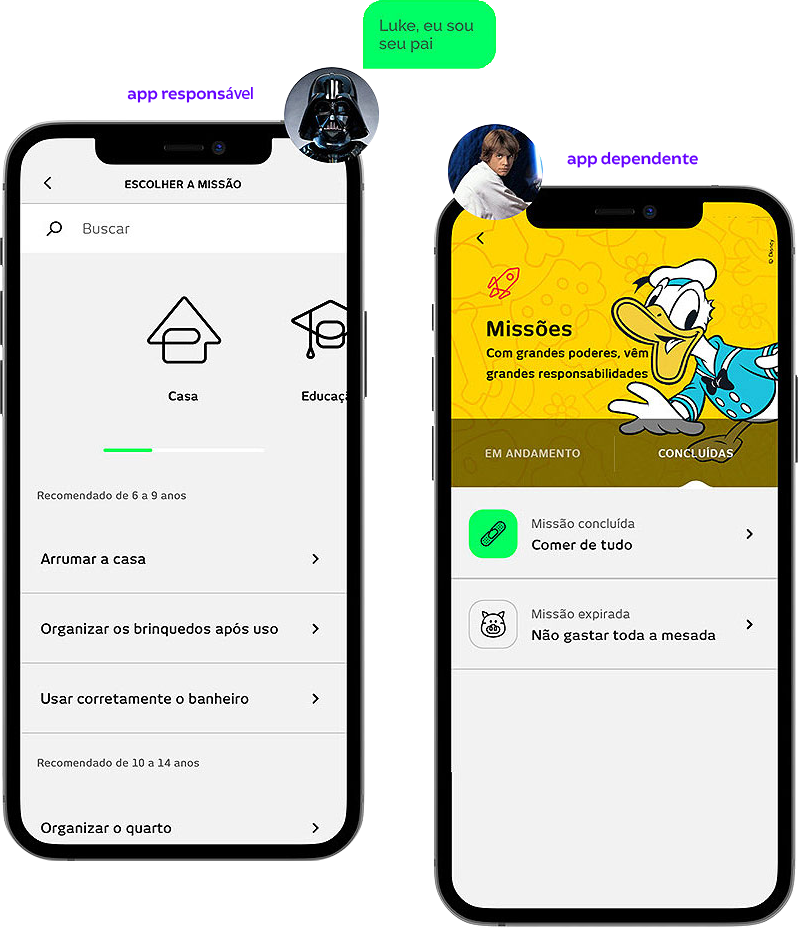

In addition, guardians can create missions and allowances, gamifying daily routines and learning.

Involvement and Responsibilities

In this project, I was involved in every stage as the lead and main designer, working end-to-end. On a personal level, I learned a lot, especially about taking initiative and navigating a corporate culture undergoing digital transformation.

I believe my focus on quality and delivering value led to great results! The changes and the narrative we cultivated as a UX team spread and helped the product evolve. We achieved the key metrics and expectations for the project:

Increase in Next customers

Greater brand relevance

Growth in the number of daily transactions

Go ahead and open your account too. Learn more at